The issue of income inequality divides the nation and is a source of social unrest. The government, led by the Democratic Party and President Biden propose a traditional approach of taxing “the wealthy” and providing broad social welfare programs to address income inequality. This is a classic redistribution of wealth where taxes are raised on one class of people and given to another to achieve “fairness” of some sort. Providing these kinds of social programs have been tried since the 1960’s and have not proven to end poverty or to deliver long-term prosperity to the country’s citizens. If they did, we would not still be talking about raising taxes to fund social programs that raise living standards.

Traditional social programs may help the political party proposing them to gain voter support, but they don’t permanently address issues like income inequality. Eventually they become a burden so great that taxpayers vote in a new set of government leaders who undo or “reform” the social program legislation that transfers wealth from one class to another. The less fortunate never seem to have their circumstances changed fundamentally as a result.

The best ways to attack income inequality include educating the people, or giving them an incentive to better educate themselves, and through helping citizens have a “stake” in the capitalist economy. Both of these goals can be achieved with long term approaches where the power of compounding returns in the public stock markets are used to improve the lives of U.S. citizens. This is a radical new approach that is intended to make people more reliant on the success of capitalism than the largess of government.

Root of The Problem

Most arguments I see around income inequality end up with the statement: “the top earners have access to financial assets, and the lower earners struggle paycheck to paycheck because they do not (have such access to financial assets)”.

These debates almost universally start with arguments about how “the wealthy” don’t pay enough in taxes and end in agreement (almost as an after thought) that the middle and upper classes have access to stock portfolios through ownership of 401K or IRA accounts, or outright stock ownership. leading to income disparity between the two groups. There is a lot of disagreement over what “the fair share” is that should be paid by the wealthy. There seems to be no disagreement that the issue is that lower income individuals don’t have financial assets, and that financial assets are the best way to grow wealth over the long term.

“New Thinking” for a Solution

So why don’t we give everyone interests in the capitalist economy by making sure that they have tax-advantaged access to stocks? Stocks have historically grown between 8% and 10% per year since the year 1900. This source calculates that the return on stocks has been 9.85% over this period of time. The same source shows that the inflation-adjusted return on equity assets over that period of time is 6.76%. Given that this includes a couple of highly inflationary periods (after World War II and again during the commodity shock driven inflation of the 1970’s), and that central banks may have a much better handle on monetary policy to fight runaway inflation than they once did, one could assume that inflation-adjusted returns in the stock market could (over long periods of time) average around 8% annually.

This assumption around 8% growth in the stock market is a bit on the optimistic side, and Stan Druckenmiller (famous investor) on CNBC recently, cast some serious doubt on the central bank’s ability to control inflation with all the recent stimulus spending proposed by the Biden administration, but for sake of argument, let’s go with the 8% assumption.

At 8% compounded annual returns, the government could fund two programs that take advantage of the growth that is possible with equities in the stock market. One that would help citizens gain an education and one that gives them a way to own stocks and financial assets that at least fund their retirement and give them some security in their retirement and older years.

These would be an “Educational Assistance Fund” and a “Birthright Fund” (the latter fund was proposed by Bill Ackman, famous hedge fund manager and private investor). These proposals would both start off with the Government providing an investment at the outset, but the money provided would be invested in zero-cost index funds where it would grow tax-free and benefit the owner (individual citizens) at some point in the future. The “Big Idea” behind both of these programs would be that the stock market and its compound growth over time would provide the funding for the benefits, not ongoing taxpayer dollars.

The Proposals

Educational Assistance Fund

The concept of an Educational Assistance Fund is simple. Have the government “seed fund” an initial investment of $100 billion and invest it in zero-cost index funds that would yield about 8% per year. Pay benefits out of this fund to graduates of training programs (technical trades, IT training, or traditional college degree programs) as the fund produces returns. Students would put “skin in the game” by borrowing the money to train themselves, but would qualify for payments from the Educational Assistance Fund to enable them to pay the tuition back to qualified institutions.

The program would have “stage one” where the initial government investment provides the available benefits for the first ten years of the fund. The second stage of the program (“stage two”) would be funded in the first ten years by a corporate tax on companies making $100 million or more in profits. This money would compound in value for ten years while the stage one investment return dollars are paid out as benefits. Stage one would provide help to graduates immediately, stage two would provide enormous benefits to graduates, contributing life-changing aid to those who are employed and who sought an education.

The stage one of the programs pays out benefits of around $8 billion per year (8% of the $100 billion invested by the government). During the first ten years (as stated above) a 1/2 of one percent corporate income tax on corporations that have more than $100 million in profits would be collected and invested in the zero-cost index funds that also contain the first $100 billion. After ten years that second stage fund would begin paying benefits too, but at that point the fund would have grown substantially larger and the benefits available to students would be much greater.

To qualify for access to the funds, and to give graduates an incentive to major in fields where employment is most likely, the educational assistance fund would only pay out to employed graduates. If a college graduate were employed, they could qualify for amounts as large as $20,000 (or more, depending on the performance of the index funds, and the number of participants requesting benefits) in benefits per person per year sometime after the ten year “second stage” phase of the proposal.

This would be a huge boost to graduates who would otherwise experience large debt burdens from earning their degrees. It would also encourage those who earned a degree in one discipline where employment is unlikely to get further education and obtain a degree where employment is more likely.

A student in any type of program (Four year baccalaureate program, graduate school, trade school, IT training, etc.) would qualify. They could borrow the money to attend training classes and gain access to the educational fund distributions to help them pay it back after they graduate and become employed. The payments would be made to the educational institution by the employer and the employer would be reimbursed by the educational assistance fund. Students could remain eligible for payments from the fund until their debts are paid off through distributions from the fund.

Seed funded Stage (first Ten Years)

The educational assistance fund would be “seed-funded” by the government initially. The first $100 billion would be a one time investment that would be invested in zero-cost index funds. With an 8% annual return this would provide $8 billion per year that could be spent to offset student debt for graduating students of specific trade or technical programs, or graduating seniors and graduate students from traditional college programs..

The government could earmark $100 billion as an “endowment” to fund the program and an additional $8 billion if benefits were to be paid out immediately (without waiting for the investments to compound), making the initial investment $108 billion in the Educational Assistance Fund.

There are around 2 million undergraduate (bachelor degrees) awarded per year, so this $8 billion could provide $2,000 – $4000 per person/year in immediate aid to offset borrowing costs. This is an estimate as vocational training and IT training programs are also included. As an estimate, somewhere in this range is a feasible assumption and would be a great benefit to those seeking job training.

In “stage two” of the fund (explained next) the fund will have grown in magnitude and the benefits paid out of the fund will be much larger than the benefits paid out of the fund in stage one. In stage two of the fund, the payments to graduates would increase approximately ten times from what they were in stage one.

Self-sustaining Stage (After Ten Years of Compounded Returns)

The second part of the educational assistance fund would be paid in to the fund by corporations with profits greater than $100 million per year. During the first ten years of the fund the corporate contributions will be reinvested in the stock market and allowed to grow. No benefits would be paid out from the collection of the funds from the corporations until after year ten of the fund.

The Fortune 500 last year posted profits of $14.2 trillion. A half-percent tax on the profits of Fortune 500 corporations alone would provide $71 billion a year. $71 billion invested in the fund every year for ten years (with 8% annual return compounding) would yield $1.1 trillion (at the end of ten years). The actual amount in the fund after ten years would be larger than the $71 billion because there are more than 500 companies making profits greater than $100 million. I just used the magnitude of the profits of the Fortune 500 to show the feasibility of the concept.

So the fund would be at least $1.1 trillion after ten years and probably much larger than $1.1 trillion with all companies making more than $100 million in profits (not just the Fortune 500) paying their contributions into the fund. This assumes that the assumption of 8% compounded annual returns holds true over the first ten years of the fund. Given the uncertainty of the returns but that there will be more than $71 billion per year paid into the fund (due to more than the Fortune 500 contributing) it is clear that this proposal is feasible.

If the fund were $1.1 trillion after ten years the amount invested in the fund would provide $88 billion in investment income per year. This assumes that no further corporate contributions were made into the fund after the ten year “waiting period”. With further contributions (which there would be) the fund would grow larger, albeit at a smaller rate of increase since the returns on the index funds would be getting paid to graduates. Also with a $1.1 trillion base and the original $100 billion “seed” amount from stage one of the proposal, the fund would be at least $1.2 trillion.

With $1.2 trillion available and an 8% return assumption, this could yield approximately $96 billion in benefits per year. This spread over 2 million – 4 million participating students graduating from some kind of program each year, would yield between $24,000 and $48,000 per student (depending on returns and participation rates).

If the average debt burden on a graduate were $40,000 per year and the returns of the fund were spread over existing and new graduates each year, participants in the program could retire their debt in a few years. After year ten (phase two of the plan) overall debts of newly graduating recipients could be paid off within one or five years (depending on the number of graduates and the performance of the invested platform assets). This is without the student making payments from their own funds.

This would be possible because during the second stage of the plan, those getting access to fund distributions could receive between $10,000/person/year and $40,000/person/year. This would relieve their debt burden more quickly than was possible in the first ten years of the plan. Because congress would be prohibited from taking any of the assets paid into the fund for any other purpose, and payments into the plan by corporations would continue every year, the fund would continue to grow and benefits could grow over time.

The important part of this plan is that it would not require ongoing taxation to fund the “educational trust fund” and it would provide incentives for graduates to remain employed to qualify for the automatic payoffs of their loans in a few years. Income redistribution (through taxation) would not be necessary and the trust fund would pay employers to relay the payments to qualifying graduates. The government would only be minimally involved.

The trust fund would be managed by index fund managers, not the government. Benefits would be tax-free to recipients and free them from the payments on their debt sooner. This would allow employed graduates to enjoy more disposable income and to build their lives more comfortably sooner than they could without such a plan.

The BirthRight Fund (Bill Ackman’s Idea)

This idea is brilliant and simple: give each newborn baby a stipend and invest it for them in a zero-cost index fund. The investment will grow tax-free throughout a person’s lifetime and at age 65 they are eligible to withdraw funds from it.

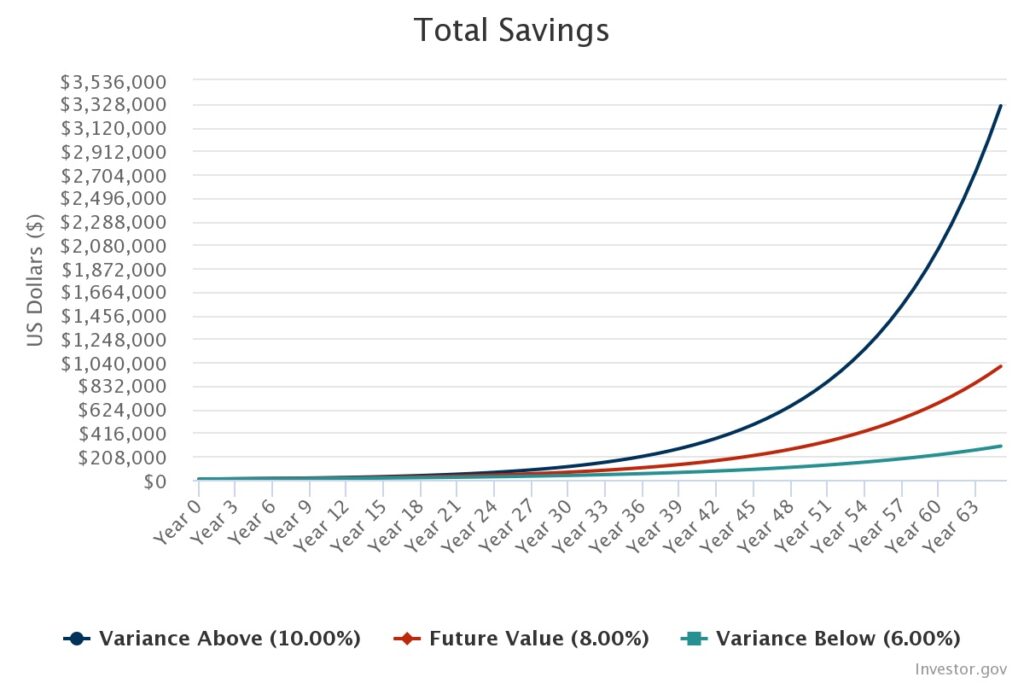

The idea of giving every new born baby a “stake” in the economy belongs to Bill Ackman, the famous hedge fund manager and CEO of Pershing Square Capital Management. In an article he authored for The NY Times Deal Book series, Mr. Ackman explains how $6,750 invested at the birth of a child will grow to over $1,000,000 by age 65 and $2 million after 74 years, assuming an 8% annual return. His “Birthright fund” (as he calls it in his article) would be invested in zero-cost equity index funds. Individuals would not be allowed to withdraw funds until at least age 65.

Mr. Ackman’s idea is brilliant as it harnesses the magical principal of compounding annual returns (just like the educational assistance fund). When returns (dividends and share growth) are allowed to be reinvested and to compound within the Birthright fund, the holder has an ever-growing asset tied to the success of the economy and the capitalist system. Growing tax-free within the account, the holder of the Birthright fund holds shares in a broad swath of the capitalist economy. Given historical growth rates of the stock market as a whole of 8% to 9% over the last 70 years, it is a reasonable assumption that the Birthright fund would be a great place to grow wealth for all Americans.

In the following chart, generated from this source, the concept is illustrated. A baby born into the BirthRight Fund will see the initial $6750 investment grow to be worth over $1 million in 65 years.

The initial stipend of $6750 would be invested at birth and held in the BirthRight Fund (as Mr. Ackman named it) until a given person with rights to the fund turned age 65. The funds would compound tax-free and there would be no tax penalty at the end of the investment period (a minimum of 65 years, the recipient could let it grow in the fund longer). At age 65, the money could be drawn to pay for living and retirement expenses.

Things I would add include that the fund (and the educational assistance fund) could never be diverted by congress to any government purpose, the fund amounts can never be borrowed against (like with an IRA) and the funds can be inherited by one’s family as part of their estate. In all respects the funds are theirs, the future recipient is the sole owner of the funds and they are not subject to inheritance or “wealth taxes” in any way.

This plan depends on the historic rates of return holding up over the 65 years of a person’s life, so that is a risk worthy of noting. The risk of inflation eroding the returns is larger with this plan than the educational assistance fund as the BirthRight Fund will pay for future expenses denominated in dollars.

The educational assistance fund will pay off dollar amounts set in the past so inflation is not as much a worry. The educational assistance funds will be paid toward a fixed amount of dollars that was the cost of a past education, the BirthRight fund will be paying for expenses in the future that might fluctuate higher than anticipated in dollar terms.

Over such a long period of time (65 years or more), the funds would grow significantly and a recipient of the BirthRight fund would still be imminently better off than they would without it. Within such a timeframe, the growth rates of equity investments are likely to remain near historical averages. The power of compounded annual returns is so strong that betting on the phenomenon is a worthwhile gamble. Inflation erosion aside, the BirthRight Fund is a brilliant idea and Mr. Ackman should be lauded for proposing it.

Benefits of this approach

This is very good for women. Women who decide to take care of children or another family member during their lifetime continue to accrue the benefits of the capitalist system. They are not tied to their husband’s earning power should they feel that they have to prioritize child or elder care over career earning power. Many women who get divorced are dealt a major long-term setback economically. This would cushion that blow significantly.

This allows the very disadvantaged and those from economically challenged backgrounds to achieve and build household wealth. African-American families, Latino families as well as poor white families would all benefit equally from the BirthRight Fund. Non-white families have much lower household net worth than white families in the United States. This would level the playing field in that respect significantly.

This could solve the Social Security problem entirely. With means testing of benefits, a family with the BirthRight benefits would not need Social Security. The Social Security system could eventually be phased out as it would no longer be needed. The current Social Security tax paid to the government could be eliminated or diverted to a health-care fund that could offset medical expenses in one’s later years.

The truly disadvantaged would be able to take risks they otherwise not have been able to take. Starting a business and knowing that one’s retirement is still available to them could allow a “burst” of entrepreneurial activity to occur. This would be a huge benefit of such a plan.

The biggest benefit would be that this ties (as Mr. Ackman points out) each citizen to the success of the American capitalist system. Instead of relying on the government to provide assistance to families in their retirement years, each person can count on the success of the places they work and the country as a whole to provide for them.

Overall Benefit

The tendency to think of corporations and “the wealthy” as the enemy would be reduced with both of these plans. The success of the economy would be paying individuals who educate themselves and take risks to build their careers. It also binds individuals to the “American Dream” of hard work and self fulfillment. Both of these plans would be worthy of implementation and would go a long way toward providing equal opportunity for all. Social cohesion, not social division would result as more Americans feel tied to the economy.